Is Your Bitcoin Safe? The Human Rights Foundation (HRF) Warns Millions of Bitcoin Are at Risk

Bitcoin has always stood out as a trailblazing digital currency, founded on strong security and the idea that anyone, anywhere, can participate. Over the years, its technology has steadily advanced, particularly in the structure and protection of wallet addresses. Now, a new challenge has emerged: quantum computing, a significant leap in computer science with the potential to disrupt Bitcoin’s core security features, as highlighted in a major 2025 report by the Human Rights Foundation (HRF).

Understanding Bitcoin Wallet Addresses

To send or receive Bitcoin, users rely on wallet addresses, which are strings of letters and numbers similar to account numbers, but designed specifically for digital transactions. In the early days of Bitcoin, addresses were directly tied to public keys, making them simple but less secure. As risks became apparent, such as attackers tracing payments or targeting reused keys, the Bitcoin community upgraded to new address formats for greater privacy and safety.

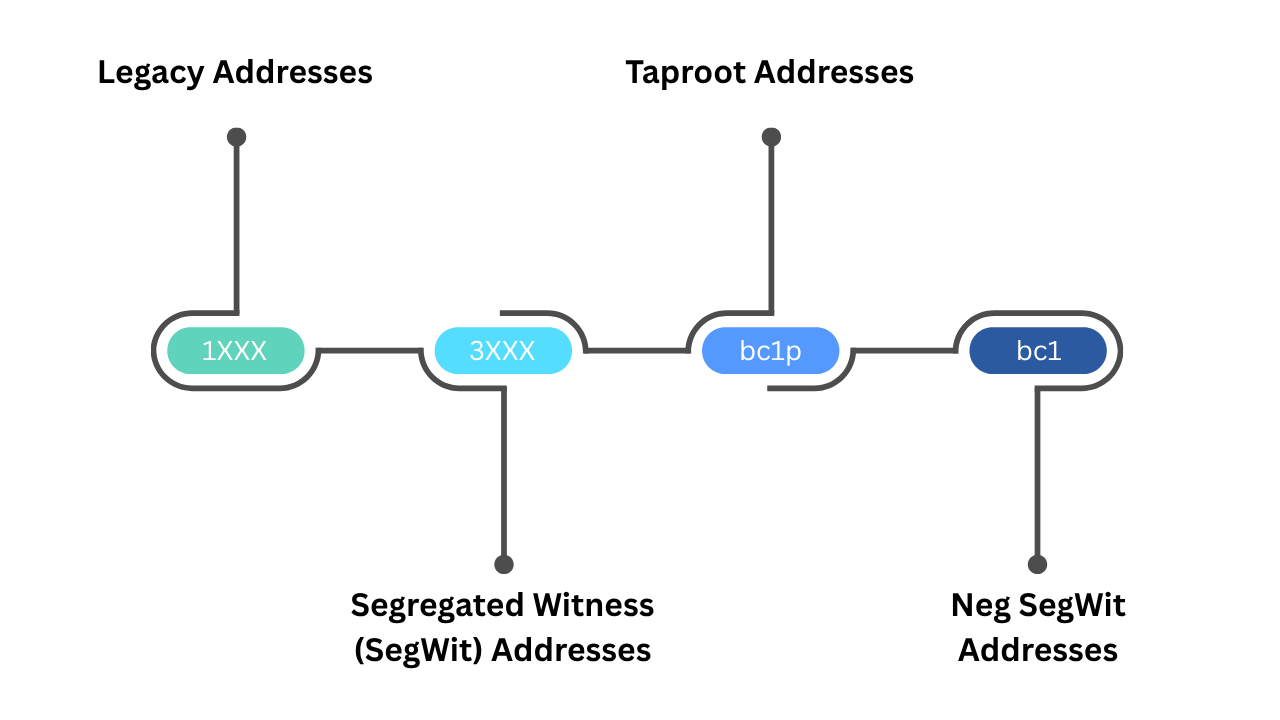

Wallets have evolved over time in four stages:

Legacy (P2PK, P2PKH): Old-style addresses, starting with “1”, were vulnerable if reused. Inactive coins from Bitcoin’s earliest era, including Satoshi Nakamoto’s legendary holdings, still reside here.

Script (P2SH): Launched in 2012, these addresses start with “3” and support group wallets and more varied transactions.

SegWit/Bech32 and Taproot: Newer addresses, starting with “bc1”, minimize fees, reduce errors, and boost privacy and flexibility. Wallets now generate a new address for every payment, making your transaction history harder to track and your funds safer.

Modern wallets are “hierarchical deterministic,” meaning that they generate all addresses from one backup phrase. This means you can always recover your entire wallet, even if your device is lost or damaged.

Here is a guide to the wallets that may help you better understand the technology, if interested.

The Challenge of Quantum Computing

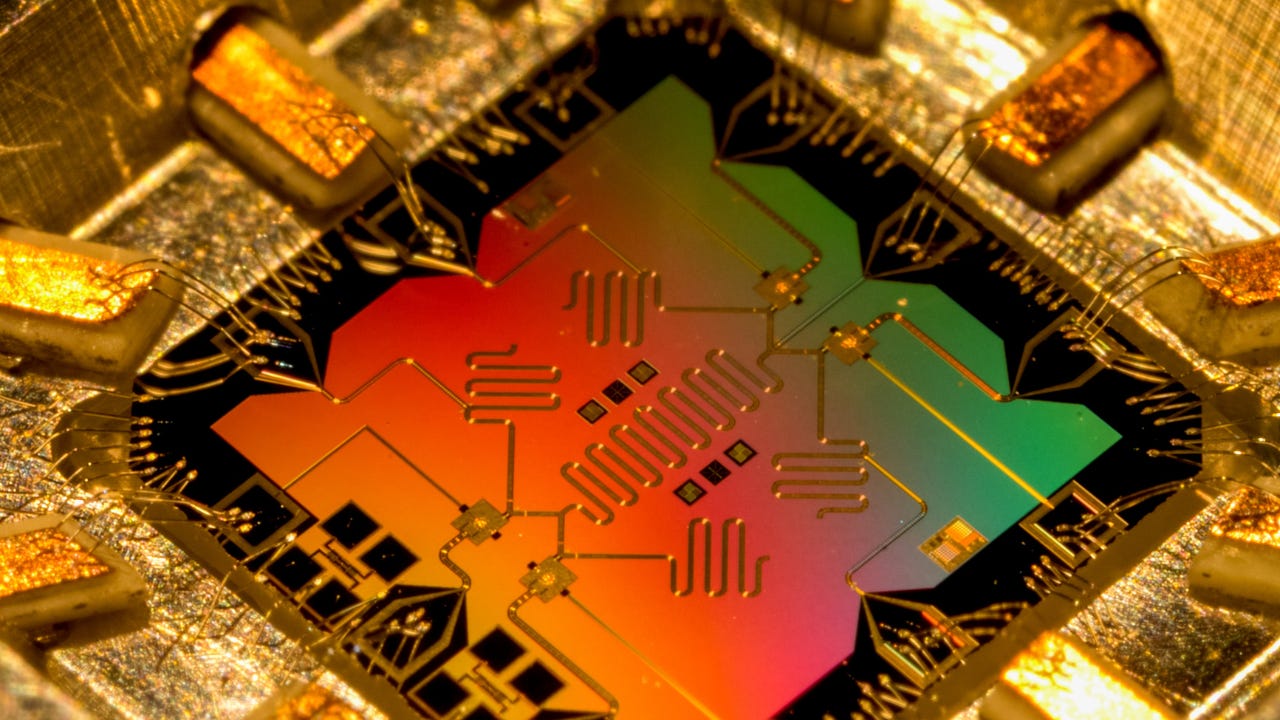

Quantum computing is a revolutionary approach to how computers process information. Unlike regular computers, which operate in binary (ones and zeros), quantum computers utilize “qubits” that can perform powerful calculations significantly faster. With enough power, these machines could crack the cryptography protecting Bitcoin wallet addresses, allowing attackers to discover your secret password simply by knowing your address.

The threat isn’t science fiction anymore: IBM and Google’s progress in quantum hardware, along with expert opinions collected at the July 2025 Presidio Bitcoin Quantum Summit, point to a possible five- to ten-year window before quantum computers could break Bitcoin’s encryption.

HRF Report: Who and What Is At Risk?

The HRF’s report, released this week, reveals that approximately 6.51 million Bitcoins (nearly one-third of all currently available coins) are vulnerable to quantum computer theft, particularly those stored in older address types or dormant wallets from Bitcoin’s early days (Satoshi-era addresses). These “long-range attacks” could target coins where public keys are exposed on the blockchain.

Additionally, “short-range attacks” can occur in real-time. Anytime you send Bitcoin, your wallet’s public key becomes visible until the transaction is finalized on the blockchain. If quantum computers become fast enough, attackers could intercept and reroute these funds before they’re confirmed.

Experts agree that moving coins from older addresses into updated, quantum-resistant wallets can significantly lower risk; however, the upgrade process is complicated and slow due to Bitcoin’s decentralized nature and technical constraints.

Technical Challenges and Proposed Solutions

Switching Bitcoin to quantum-resistant cryptography by using new algorithms like SPHINCS+ or BIP360 is not easy. These systems create larger, bulkier signatures, which can slow down the network and increase transaction costs. Every wallet, miner, and node operator would have to update their software and practices to remain secure. Achieving consensus for these changes within Bitcoin’s global community could take years.

One proposal, called “Hourglass,” suggests limiting the speed at which vulnerable coins can be spent, thereby giving the community time to react in the event of a quantum attack. Ongoing research and education are being funded by organizations like HRF to develop migration tools and testnets that could facilitate Bitcoin’s transition to quantum-resistant technology.

What Can Everyday Bitcoin Users Do?

Use modern wallets that create new addresses for each transaction.

Don’t reuse wallet addresses to confirm you benefit from enhanced privacy.

Back up your recovery phrase in a safe location to protect against device failure.

Watch for wallet updates designed to protect against quantum threats.

Stay informed: As quantum technology advances, it will be critical for users to update wallets and security practices in line with expert recommendations.

Ultimately, Bitcoin’s address technology has become increasingly complex as its value and popularity have grown, with each new upgrade making transactions safer and more difficult to track. Yet quantum computing is a disruptive force that could put millions of coins at risk, unless the community acts decisively. According to the HRF’s 2025 report, proactive upgrades and widespread education are now essential to secure Bitcoin’s future and continue providing financial freedom for users worldwide.

Follow and Connect with the Author, Deanna Heikkinen

Connect with Deanna on X HERE

Buy her Bitcoin books for adults and children HERE

Learn about her Bitcoin Education organization HERE.

On Substack Deanna Heikkinen

About the Author

Deanna Heikkinen is an author, historian, and educator with over 15 years of experience in teaching. Holding a Doctorate in Education and Master’s degrees in both History and Anthropology, she brings deep academic insight and a love of storytelling to her exploration of world history, Western civilization, and the evolution of money. She co-authored, with her husband Joel, the 2004 book Shells to Satoshi: The Story of Money & The Rise of Bitcoin, which follows the development of money from ancient exchange systems to digital currency. Her 2025 book Ownschooling: Bitcoin, Sovereignty, and Educationencourages families to reimagine education, sovereignty, and financial literacy in an increasingly decentralized world. She is also developing a multi-level children’s book series that introduces the story of money, from cowrie shells to Bitcoin, to young readers.

As the founder of The Money Wisdom Project, a new nonprofit educational initiative, Deanna seeks to educate children and communities about the history of money and Bitcoin. The organization is working to create comprehensive curriculum packets on the history of money and Bitcoin to distribute free of charge to teachers, schools, communities, and Bitcoin circular economies. The project’s mission is to deepen financial and historical literacy while donating books on the history of money and Bitcoin to schools and public libraries worldwide, empowering learners of all ages to connect the lessons of history to today’s monetary systems.